If you are looking for a solar energy system, you may have heard of the Federal Investment Tax Credit (ITC). This allows homeowners to get a return on their investment in solar energy by offering a tax credit equal to 30% of the system’s total cost. Therefore, it is crucial to understand the process of claiming credit when filing taxes.

This article will guide you through the steps to determine eligibility, what forms are needed to complete, and how to file for the investment tax credit.

Guidelines for Obtaining Solar Tax Benefits

1. Determine if you are qualified

You are eligible for solar tax benefits if you own a solar energy system. The path to the tax credit is only available when you buy the system, be it finance or cash. If you lease your system, the third party will receive the solar tax credit. This is usually the same for most state and local incentives for solar energy; however, there are some exceptions where a lease agreement can grant you the financial advantages connected to the sale of Solar Renewable Energy Certificates (SRECs). Even if your solar energy system is not on your primary residence, you can still be eligible for the solar tax credit as long as you own the property and stay in it for at least a portion of the year.

2. Fill up Form 5695

Once your solar power system has been installed, complete IRS Form 5695 to apply for the tax credit.

How to fill up IRS Form 5695

1.File IRS Form 5695 as part of your tax return.

2. In the first part of the form, calculate the credit of the tax form.

3. File your solar system as “qualified solar electric property costs.”

4. On line 1, put in the total cost of your project as listed in the solar contract.

![]()

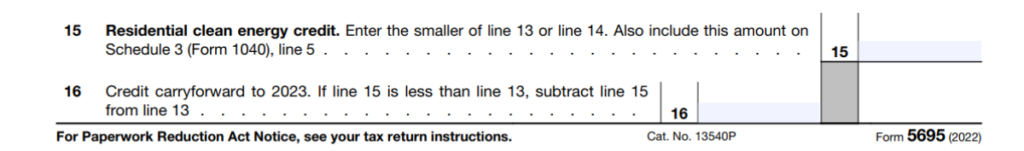

5. For lines 6a and 6b, fill in the appropriate calculations.

6. One line 14, calculate any tax liability limits using the IRS’s Residential Energy Efficient Property Credit Limit Worksheet

![]()

7. Lines 15 and 16 must be completed with the correct computations.

8. Finally, on line 5, enter the exact figure from line 15 on your Schedule 3 (Form 1040).

You can carry over any unused tax credit from your previous tax year.

What does the federal solar tax credit cover?

If you recently installed a solar energy system in 2022, you are eligible to claim a federal tax credit that covers 30% of the following:

- Solar panel cost

- Solar equipment costs (inverters, wiring, and mounting hardware)

- Solar panel installation labor costs

- Permit and inspection fees

- Solar power storage equipment or batteries with at least 3 kilowatt-hours capacity

- Sales taxes paid for eligible solar installation expenses

What forms do you need to fill out to claim the ITC?

Here are the forms you need to complete and submit to claim your solar rebate. Before filling out the details, read the instructions first.

Frequently asked questions about the solar tax credit

How does the solar tax credit work in 2023?

The Solar Investment Tax Credit (ITC) is a federal tax credit that can reduce the cost of solar energy systems. Eligible solar energy systems can qualify for a 30% tax credit, which is applied as a dollar-for-dollar reduction in the income tax you would otherwise owe. The system must be for your primary or secondary residence in the U.S. The credit is claimed on your federal income taxes, and if the credit is larger than the amount of tax you owe, you will not get a tax refund.

How many times can you claim the tax credit?

You can claim your solar tax credit once the solar panel system installation is complete. Any unused solar tax credits that cannot be claimed in a given year can be rolled over to the following tax year.

Is it refundable?

It is non-refundable. To get a refund, you must have a solar tax credit that is more than your solar tax liability.

Is there an income limit for the tax credit?

No matter your income level, you can claim federal solar tax credit if you have enough tax liability. If your taxes are lower than the credit, the outstanding amount will be carried over the following year.

Can I use the tax credit if I do not owe any taxes?

You are only eligible for a solar tax credit if you file your federal income taxes.

How does the Federal solar tax credit affect other solar incentives?

Besides the federal solar tax credit, there are many other rebates, programs, and state tax incentives that you can access depending on your location. While most incentives do not affect the ITC, others reduce the overall installed cost of the system.

The reduction will affect the total cost you report to the IRS on your tax return. For example, utility rebates are usually not deductible from your income tax. Instead, the rebate amount is deducted from the total cost of installing your solar system.

On the other hand, incentives such as state rebates and renewable energy certificates will not affect the ITC. However, these incentives affect other aspects of your income taxes. State rebates are added to your taxable income but do not affect the federal income tax credit.

State tax credits are tax incentives that reduce the tax owed at the state level. However, if you owe less state tax, you will owe more federal income tax because there is less state tax to deduct.

Switching to solar?

Residential energy customers can be intimidated by the cost of switching to solar, but the state’s tax credits help offset some of the cost. This tax credit, along with other solar incentives, credits, and rebates, makes the process as affordable as possible.

DroneQuote is here to help you on your solar journey and provide you with solar quotes from trusted solar companies in your area. If you are a homeowner looking to switch to solar, we encourage you to find the best solar company to begin the process before the ITC deadline. We will ensure your solar questions are answered honestly and professionally. Contact DroneQuote here.

[…] Federal Solar Tax Credit, known as the Investment Tax Credit (ITC), is a substantial solar incentive for homeowners. It […]

[…] Federal Solar Tax Credit, also known as the Investment Tax Credit (ITC), is a significant financial boon for homeowners who […]