Introduction

Solar energy has become increasingly popular among homeowners seeking greener, cost-effective alternatives to traditional power sources. With a solar panel system, you not only contribute to a sustainable future but also enjoy significant savings on your electricity bills.

However, the initial investment required for installation can be daunting. That’s where financing options come into play, allowing you to spread out the costs while reaping clean energy’s benefits.

This blog post explains how to calculate these potential savings in our step-by-step guide covering critical factors such as loan interest rates and tax incentives.

| Key Takeaways |

|---|

| Installing a solar panel system can help homeowners save significant amounts on energy bills, with an average monthly savings of $100. |

| To calculate the potential savings of a solar panel system with a loan, homeowners need to determine the total installation cost, find suitable loans and interest rates, estimate energy production and consider tax incentives. |

| Researching different solar panel options is crucial to finding the best fit for your home's needs and budget while maximizing energy savings. |

| Investing in solar panels saves money and contributes towards environmental sustainability by reducing carbon footprint. Furthermore, installing solar panels can increase home value by up to 4.1%. |

Understanding The Cost And Savings Of Solar Panel Systems

Solar panel systems may require a significant initial investment, but they can provide long-term savings on energy bills and potentially qualify for tax credits and incentives.

Initial Installation Costs

The initial installation costs of a solar panel system can vary significantly based on factors such as the size and type of panels, the complexity of your roof, and local labor rates.

On average, homeowners can expect to spend between $15,000 to $25,000 for a standard solar panel installation. This includes the panels’ cost and other essential components like inverters, mounting hardware, wiring connections, permit fees, and labor charges.

However, it’s important to remember that these upfront costs don’t tell the whole story when evaluating whether or not solar is a good investment for you.

Potential Savings On Energy Bills

One of the biggest benefits of installing a solar panel system is the potential savings on your energy bills. With a solar electric system, you can generate electricity and reduce or eliminate your dependence on the power grid, resulting in significantly lower monthly energy bills.

According to recent studies, homeowners who install solar panels typically save an average of $100 monthly on their energy bills.

Another factor that contributes to these potential savings is net metering. This allows homeowners with solar panels to sell excess electricity to their utility company at retail prices, effectively earning them credits toward future bills.

Tax Credits And Incentives

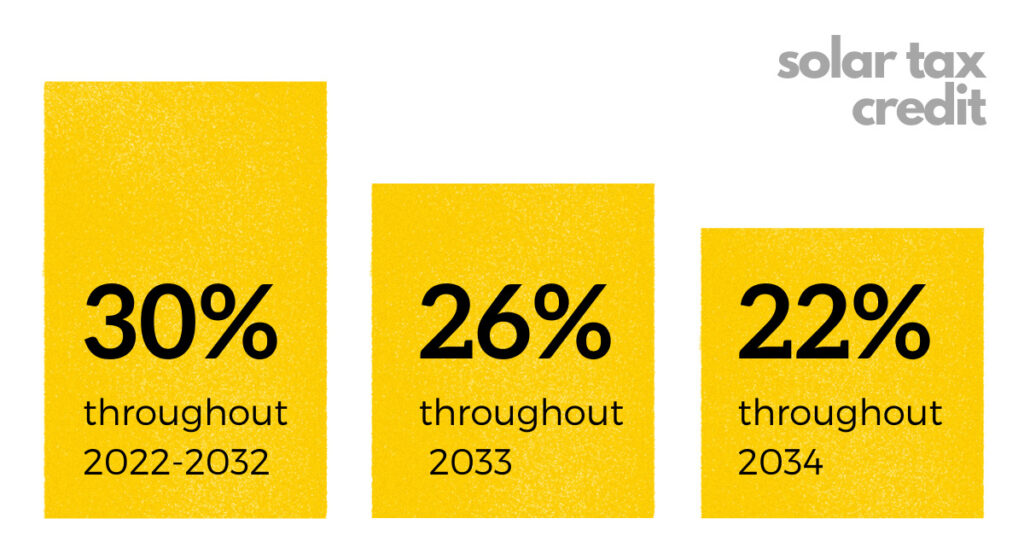

Several tax credits and incentives are available for homeowners who install solar panel systems. One of the most significant is the Federal Solar Tax Credit, which offers a 30% tax credit off the entire cost of a solar panel system.

In addition to the Federal Solar Tax Credit, many states offer tax credits or other incentives for installing solar panels. For example, California residents may be eligible for cash rebates through the California Solar Initiative program. In contrast, Massachusetts residents can use programs like Mass Save or Clean Energy Center that provide similar support.

How To Calculate Solar Panel Savings With A Loan: A Step-by-Step Guide

This section will provide a clear guide on calculating the savings of a solar panel system with a loan, including determining system cost, finding loan interest rates, calculating monthly payments and energy production, considering tax incentives, and calculating net savings.

Determine System Cost

To calculate the savings of a solar panel system with a loan, you first need to determine the cost of installing the solar panels. This includes both equipment and installation fees.

You can do this by comparing solar quotes from different providers in your area.

It’s important to factor in any incentives or rebates that might be available when calculating the cost of your system. For example, the Federal government currently offers a 30% tax credit off the entire cost of a solar panel system.

Additionally, some states offer incentives or rebates for installing renewable energy systems such as solar panels.

Find Loan Interest Rate

To calculate the savings of a solar panel system with a loan, finding the right loan interest rate is crucial. The interest rate is how much extra you will pay in addition to the principal amount borrowed.

You can use an online calculator or consult a lender to determine your interest rate and monthly payments. Remember that a lower interest rate means less money paid over time and more savings overall.

For example, if you take out a $20,000 loan for solar panels at 5% APR over 10 years, your total repayment would be approximately $25,920.

Calculate Monthly Loan Payments

Once you have determined the cost of your solar panel system and found a suitable loan with a favorable interest rate, the next step is to calculate your monthly loan payments.

To do this, you can use various online calculators or consult with your lender.

For example, if you finance a $20,000 solar panel system for 15 years at an interest rate of 3%, your monthly payment would be approximately $139. However, remember that tax incentives and rebates could lower this amount further.

Estimate Energy Production And Savings

To estimate energy production and savings, start by determining the size of your solar panel system in kilowatts (kW). Energy.gov says a typical home requires a 5 kW solar panel system.

Once you know the size of your system, you can estimate how much electricity it will produce per year based on average sunlight hours in your area.

Next, calculate potential savings on electricity bills by estimating how much electricity from the grid you’ll no longer need to purchase once your solar panels are installed.

Consider Tax Incentives

Tax incentives are an important consideration when calculating the savings of a solar panel system with a loan. The Federal government currently offers a 30% tax credit off the entire cost of a solar panel system, which can significantly reduce the overall cost.

It’s essential to research available tax incentives before choosing your solar panel system and financing options, as they can greatly impact your total savings.

Calculate Net Savings

After estimating the energy production and savings, it’s important to consider tax incentives when calculating the net savings of your solar panel system. The federal government offers a 30% tax credit off the entire cost of installing a solar panel system.

If you spend $20,000 on your solar panels, you can receive $6,000 back in tax credits. State and local governments may offer additional incentives such as tax exemption or cash rebates.

Choosing The Right Solar Panel System And Loan

Research different solar panel options and determine the loan options and terms that work best for you to ensure a high ROI and payback period – read on to find out how!

Research Different Solar Panel Options

Many different solar panel options are available, so it’s important to do your research before deciding. Here are some factors to consider when comparing solar panels:

- Efficiency: The efficiency of a solar panel is the amount of energy it can convert from sunlight into electricity. High-efficiency panels will produce more electricity but can also be more expensive.

- Brand: Look for trusted brands with a strong reputation in the industry. Research online reviews and ratings to help narrow down your search.

- Warranty: Ensure you understand the warranty each manufacturer and installer offers, including both the product and installation warranties.

- Aesthetics: If appearance is important to you, look for solar panels that blend in with your roof or come in a color that complements your home’s exterior.

- Durability: Solar panels need to withstand harsh weather conditions such as hail, high winds, and heavy snow loads, so make sure you choose a product that is durable enough for your area.

- Cost: Cost is an important factor when choosing solar panels. Ensure you get quotes from different installers to compare costs and financing options.

When considering these factors and researching different solar panel options, you’ll be able to find the best fit for your home and budget while maximizing your energy savings and environmental benefits.

Determine Loan Options And Terms

Once you have determined the total cost of your solar panel system, it’s time to consider your loan options and terms. Several financing options are available for homeowners, including loans, leases, and power purchase agreements (PPAs).

Loans can come from various sources, such as banks or specialized solar lenders.

In addition to traditional loans, some states offer special programs that provide low-interest loans or rebates for installing solar panels. Before selecting a lender or program, evaluate each option’s return on investment (ROI) and payback period.

Finally, be sure to choose a reputable lender with a track record of providing quality service in the industry.

Evaluate ROI And Payback Period

Evaluating the return on investment (ROI) and the payback period is important in choosing the right solar panel system and loan. ROI measures how much money you’ll save over time compared to the initial installation cost, including financing costs.

A shorter payback period means you will break even with your purchase sooner rather than later.

For example, suppose a homeowner installs a solar energy system for $20,000 after applying rebates or incentives and finances it at an interest rate of 3% over ten years.

In this case, they would need to produce energy savings of more than $2,200 per year to achieve a four-year payback period. Additionally, if their electricity bill averages around $200 per month before installing the panels, they could expect monthly savings of about $85 for each kilowatt-hour produced by their array annually.

Find A Reputable Lender

Choosing the right lender for your solar panel loan is a crucial step in the process. Working with a reputable lender ensures you get fair and transparent terms for your financing.

You can start by researching different lenders and their offers, comparing interest rates, loan terms, and fees. Look into customer reviews and ratings to see what other people’s experiences have been like working with those lenders.

It’s also important to consider the lender’s experience in solar panel financing specifically, as this can help ensure they understand the unique needs of this type of loan.

Additional Benefits Of Solar Panel Systems With Loans

Installing solar panels with a loan also increases home value, reduces carbon footprint, promotes energy independence, improves energy efficiency, and enhances environmental sustainability.

Increased Home Value

Installing a solar panel system can increase the value of your home. According to recent data, homes with solar panels have an increased resale value of up to 4.1% compared to homes without them.

Furthermore, homes that are environmentally friendly and energy-efficient are in high demand among modern buyers.

Reduced Carbon Footprint

Installing a solar panel system can reduce your carbon footprint and help the environment. A typical residential solar panel system offsets about 100,000 pounds of carbon dioxide over its lifetime.

This is equivalent to planting approximately 1,000 trees or taking two cars off the road for a year. By relying on renewable energy instead of fossil fuels, you can significantly reduce your household’s contribution to greenhouse gas emissions and take action towards a sustainable future.

Energy Independence

Owning a solar panel system with a loan can give homeowners energy independence. By generating electricity from the sun, they rely less on utility companies to power their homes.

This means that even during power outages or high demand, homeowners can still have access to electricity.

According to recent studies, investing in solar panels can reduce carbon dioxide emissions by up to 95% compared to traditional fossil fuel sources for electricity generation.

Furthermore, installing a solar panel system with a loan allows homeowners to control their energy usage and costs while promoting sustainability.

Improved Energy Efficiency

Another benefit of installing solar panels is improved energy efficiency. Solar panels generate clean electricity from the sun, so homeowners can reduce their reliance on traditional power companies and fossil fuels.

Solar panels often come with monitoring systems that allow homeowners to track their energy usage in real time.

A study by the National Renewable Energy Laboratory found that homes equipped with solar panels use 33% less electricity than those without them.

Enhanced Environmental Sustainability

In addition to the financial benefits of installing solar panels with a loan, there are also important environmental advantages. By relying on renewable energy sources like the sun, homeowners can reduce their carbon footprint and contribute to a more sustainable future for our planet.

According to research from the National Renewable Energy Laboratory, a typical residential solar panel system can offset approximately 3-4 tons of carbon emissions annually.

Moreover, solar panels can help improve overall energy efficiency by reducing reliance on fossil fuels and traditional power grids. With energy independence provided by solar panels installed through loans, homeowners no longer rely solely on utility companies that may use nonrenewable resources or lead to increased pollution levels.

Solar power is clean, reliable, and cost-effective compared to other forms of electricity generation.

Conclusion

By following this step-by-step guide, you can easily estimate the savings of a solar panel system with a loan. When calculating your net savings, it’s important to understand both the initial installation costs and potential energy bill savings.

Additionally, explore different financing options and choose a reputable lender. By investing in solar panels, you not only save money on energy bills but also contribute towards environmental sustainability and increase your home value.

![]()

Going solar?

Make the smart choice today and start reaping the benefits of solar energy. By following our step-by-step guide, you can calculate the potential savings of a solar panel system with a loan. Take control of your energy costs and contribute to a sustainable future.

Remember that installing a solar panel system with a loan offers additional benefits beyond cost savings. Increase the value of your home, reduce your carbon footprint, gain energy independence, improve energy efficiency, and contribute to environmental sustainability.

Don’t let the initial investment deter you. Start your journey towards clean, affordable energy today. Calculate your potential savings, explore financing options, and find a reputable lender. Join the solar revolution and make a positive impact on both your finances and the planet.

Still have questions? Check out our FAQs section for more information on calculating savings, factors to consider, and potential risks. Take control of your solar future today. Visit our website, schedule an online consultation, and empower yourself with the knowledge and tools to secure the best loan rates and turn your solar dreams into a reality.

FAQs

- How do I calculate my potential savings with a solar panel system and a loan?

To calculate your potential savings, first, determine the cost of the solar panel installation and subtract any tax credits or rebates you may be eligible for. Next, estimate and compare your monthly loan payments to your current electricity bill. Finally, factor in the expected lifespan of the solar panels and any maintenance costs to determine long-term savings.

- What are some factors to consider when choosing a solar panel system with a loan?

When choosing a solar panel system with a loan, it’s important to consider factors such as the amount of sunlight in your area, energy usage patterns, financing terms, and interest rates offered by lenders.

- Can I still save money if I have limited access to sunlight or live in an area with high energy costs?

Even if you have limited access to sunlight or live in an area with high energy costs, installing a solar panel system can still result in significant cost savings over time through reduced dependence on traditional power sources.

- Are there any risks involved with taking out a loan for a solar panel system?

Potential risks associated with taking out loans for solar panels include unexpected changes in interest rates, which could affect monthly payments, and unforeseen damage that may require costly repairs not covered by warranties or insurance policies. It is essential to research all options, including lender reviews, before making financial commitments towards home improvement projects like these so that one doesn’t get overwhelmed financially later on due to a lack of sufficient preparation ahead of time.