Introduction

Electric cars (EVs) have become increasingly popular as the world approaches sustainable transportation. To promote their adoption, the U.S. government offers enticing federal tax credits for eligible new and used EVs – including plug-in hybrids and battery-electric models.

However, navigating these incentives can be overwhelming due to various eligibility criteria and requirements. That’s why we’ve created this comprehensive guide on understanding electric vehicle incentives: which cars qualify for federal tax credits, how they work, and tips to maximize your potential savings.

| Key Takeaways |

|---|

| Federal tax credits are available for new and used electric vehicles, with eligibility requirements based on battery size and range. To qualify for the full $7,500 credit, the EV must have less than 200,000 plug-in cars built before yours was delivered. |

| In addition to federal tax credits, there are also state and local incentives available for electric vehicle owners such as rebates or exemptions on sales taxes and registration fees. It's important to research what incentives are available in your state before purchasing an electric vehicle. |

| Some upcoming models that may be eligible for up to $7,500 in federal tax credits include the Ford F-150 Lightning, GMC Hummer EV, Rivian R1T and R1S, Volkswagen ID.4, and Audi e-Tron GT. Owners of these vehicles should check with their tax professional to ensure they receive all applicable benefits. |

| To claim a federal tax credit for your electric vehicle purchase or lease from January 2015 onwards: fill out Form 8936; keep all documentation related to your EV purchase or lease; consult a qualified tax professional if you have any questions or concerns regarding IRS EV tax credit process. |

How Electric Vehicle Incentives Work

Electric vehicle incentives work by providing tax credits and other benefits to those who purchase electric cars. These incentives are designed to encourage using clean energy vehicles, reduce carbon emissions, and promote sustainable transportation options.

Federal tax credits are available for new and used electric vehicles, with eligibility requirements based on battery size and range.

Federal Tax Credits For New And Used Electric Vehicles

One of the most significant incentives for purchasing an electric vehicle (EV) in the United States is the availability of federal tax credits. These credits were introduced in 2008 to encourage drivers to transition from traditional gasoline-powered vehicles to eco-friendly options, such as battery-electric vehicles (BEVs) and plug-in hybrid EVs.

In addition to new cars, used electric vehicles can also qualify for these tax credits under specific circumstances. For instance, pre-owned EVs with a price tag below $25,000 may be eligible for a credit of up to $4,000.

However, this incentive comes with conditions like income limits and other requirements that buyers must meet.

Incentives For North American Assembled Electric Vehicles

To be eligible for the full $7,500 federal tax credit, the electric vehicle must be new and assembled in North America. This requirement promotes the development and growth of EV manufacturing in North America by incentivizing consumers to buy domestically produced-electric cars.

However, it’s important to note that this requirement only applies to vehicles purchased after August 17, 2023. For purchases made before that date, final assembly in North America is not necessary for eligibility.

Examples of qualifying North American-assembled EVs include the Chevrolet Bolt and Ford Mustang Mach-E, which are both manufactured in Michigan.

Eligible Electric Vehicles For Federal Tax Credits

Discover which electric vehicles qualify for federal tax credits and how much you could save with a list of eligible EVs and details on the eligibility requirements.

List Of Electric Vehicles That Qualify For Tax Credits

Several electric vehicles qualify for federal tax credits, allowing buyers to save on purchases. The following table highlights some eligible electric cars currently available in the market.

| Make and Model | Type of Vehicle | Maximum Federal Tax Credit |

|---|---|---|

| Audi e-Tron | Battery Electric Vehicle (BEV) | $7,500 |

| Chevrolet Bolt EV | Battery Electric Vehicle (BEV) | $7,500 |

| Ford Mustang Mach-E | Battery Electric Vehicle (BEV) | $7,500 |

| Kia Niro EV | Battery Electric Vehicle (BEV) | $7,500 |

| Nissan Leaf | Battery Electric Vehicle (BEV) | $7,500 |

| Hyundai Kona Electric | Battery Electric Vehicle (BEV) | $7,500 |

| Porsche Taycan | Battery Electric Vehicle (BEV) | $7,500 |

| Tesla Model 3 | Battery Electric Vehicle (BEV) | $7,500 (before phasing out) |

| Toyota Prius Prime | Plug-In Hybrid Electric Vehicle (PHEV) | $4,502 |

| Volvo XC90 T8 | Plug-In Hybrid Electric Vehicle (PHEV) | $5,419 |

This list is incomplete as new electric vehicles continue to enter the market, and eligibility for tax credits may change. Always check the latest information on federal tax credits and consult a tax professional to ensure you receive the maximum benefits when purchasing an electric vehicle.

Future Electric Vehicles Eligible For Tax Credits

More electric vehicles will be eligible for federal tax credits in the coming years. Here are some upcoming models to keep an eye on:

- Ford F-150 Lightning: This all-electric version of America’s best-selling truck is set to hit the market in 2022 and may be eligible for up to $7,500 in federal tax credits.

- GMC Hummer EV: The highly anticipated Hummer EV is expected to go on sale later this year and could qualify for up to $7,500 in tax credits.

- Rivian R1T and R1S: These all-electric vehicles from a new EV player may qualify for up to $7,500 in tax credits.

- Volkswagen ID.4:VW’s first all-electric SUV is already available for purchase and could qualify for up to $7,500 in federal tax credits.

- Audi e-Tron GT: This luxury electric sedan from Audi will hit showrooms later this year and may be eligible for up to $7,500 in tax credits.

Keep an eye out for these models as they become available and offer potential savings with federal tax incentives while helping reduce carbon emissions.

Ford F-150 Lightning

Eligibility Requirements For Electric Vehicle Tax Credits

To be eligible for electric vehicle tax credits, the car must meet specific requirements set by the federal government. First and foremost, the EV must have a battery pack with at least 5 kilowatt-hours of capacity.

Additionally, it must be purchased new and not used.

Furthermore, to qualify for the full $7,500 federal EV tax credit, the auto manufacturer has to build less than 200,000 plug-in cars before yours is delivered. If an automaker exceeds this number in a year or quarter (depending on how they choose to report it), then its buyers will receive partial credits for six months before they expire altogether another six months later.

Finally, eligibility depends on your income level because high-income earners may not qualify for some or all of these incentives due to phased-out benefits beyond certain thresholds.

State And Local Incentives For Electric Vehicles

In addition to federal tax credits, state and local incentives are available for electric vehicle owners, including rebates, grants, and other benefits.

Additional Savings And Benefits

Besides the federal tax credits, owning an electric vehicle has additional savings and benefits. Many states offer their incentives on top of the federal EV tax credit.

For example, some states provide rebates or exemptions on sales taxes and registration fees for electric cars.

Electric vehicles typically require less maintenance than gas-powered cars because they operate on a simpler drivetrain with fewer moving parts that need servicing.

Going green has its perks too! Driving an electric vehicle helps reduce greenhouse gas emissions contributing to climate change while improving air quality by reducing tailpipe pollutants.

In summary: State incentives coupled with reduced operating costs make owning an EV more attractive over time than many anticipate.

State Tax Incentives

State and local governments also offer a variety of incentives for electric vehicle owners. These incentives can vary widely by state, but some common examples include:

- State Tax Incentives – Some states offer tax credits or rebates to offset the purchase price of an electric vehicle.

- HOV Lane Access – Certain states allow electric vehicles to use High Occupancy Vehicle (HOV) lanes regardless of the number of passengers in the car.

- Reduced Vehicle Registration Fees – Some states waive or reduce registration fees for electric vehicles.

- Charging Station Rebates – Several states offer rebates to help cover the cost of installing charging stations at home or in public spaces.

- Sales Tax Exemptions – Many states exempt electric vehicles from sales tax, saving buyers thousands of dollars.

- Clean Vehicle Programs – Some states provide grants or vouchers to assist with the purchase of an electric vehicle to meet zero-emission vehicle targets.

It’s important to research what incentives are available in your state before purchasing an electric vehicle, as these savings can add up quickly and make owning an EV more affordable over time.

Rebates And Grants

Additional savings and benefits are available for electric vehicle owners through state and local incentives, including rebates and grants. Here are some examples:

- California offers up to $7,000 rebates for new battery electric vehicles and up to $4,500 for plug-in hybrid EVs.

- New York State provides a rebate of up to $2,000 for qualifying EVs purchased or leased.

- In Colorado, electric vehicle buyers may be eligible for a tax credit of up to $5,000.

- The City of Atlanta offers a rebate of up to $2,500 for qualifying EV purchases by residents living within city limits.

It’s important to check with your local government and utility companies, as additional incentives may be available for charging infrastructure installation or off-peak charging rates. Maximizing potential savings through these rebates and grants can make purchasing an electric vehicle even more affordable.

How To Claim And Calculate Federal Tax Credits For Electric Vehicles

To claim and calculate federal tax credits for electric vehicles, the IRS provides a comprehensive guide on its website, including eligibility requirements and forms to fill out; read on to learn more about how to qualify for these incentives and save money on your next EV purchase.

IRS EV Tax Credit Process

The IRS EV tax credit process can be complicated, but understanding it is important for electric vehicle owners looking to claim their tax credits. Here’s what you need to know:

- To claim the federal tax credit for your electric vehicle, you must fill out Form 8936 and attach it to your federal income tax return.

- The amount of your credit will depend on factors such as the make and model of your vehicle, the capacity of its battery, and your income level.

- If the amount of your credit exceeds the amount of taxes owed, you may be able to carry over any unused portion of the credit to future tax years.

- The IRS allows taxpayers to claim a retroactive credit for qualified EV purchases from January 1, 2015.

- If you lease an electric vehicle, your lessor may be entitled to claim the tax credit instead of you.

- In case you are audited by the IRS, It’s important to keep all documentation related to your electric vehicle purchase or lease, including sales receipts and lease agreements.

Understanding the IRS EV tax credit process can help maximize potential savings on your electric vehicle purchase or lease. Be sure to consult a qualified tax professional with any questions or concerns.

EV Tax Credit Calculator

You can use an EV tax credit calculator to calculate the federal tax credit for electric vehicles. The IRS provides a form to help taxpayers determine their federal EV tax credit eligibility.

The form takes into account the make and model of the vehicle, as well as its battery capacity and other details.

For example, if you purchase a new qualifying electric vehicle with a battery capacity of at least 16 kWh, you could receive up to $7,500 in federal tax credits. If your tax liability exceeds this amount, the remaining balance may be carried over to future years.

Calculating your potential savings using an EV tax credit calculator is simple and straightforward.

Income Limits For EV Tax Credits

There are income limits for electric vehicle tax credits, which means only some who purchase an EV will qualify for the full amount. For example, individuals with an adjusted gross income of over $200,000 or joint filers with incomes exceeding $400,000 may not be eligible to claim the full credit.

The amount of the credit is also phased out once a manufacturer sells 200,000 qualified vehicles in the United States.

It’s important to note that these income limits only apply to federal tax credits and do not impact state or local incentives for electric vehicles. Consumers should also remember that this information may change as legislation evolves and new provisions are passed into law.

Conclusion

In conclusion, understanding electric vehicle incentives and which cars qualify for federal tax credits can help consumers save big when buying an EV. With the potential to save up to $7,500 through federal tax credits alone, knowing what vehicles are eligible and how to claim your credit is important.

Additionally, state and local incentives may offer additional savings for those purchasing an electric car.

![]()

How electric vehicles work best with solar

Installing solar panels on your electric vehicle ensures that your car is charged using 100% renewable energy, the cheapest and greenest option. Alternatively, you can install a home charging station in your garage.

Electric charging is significantly less expensive when comparing electric and gas-powered trucks, making it an ideal match for solar energy.

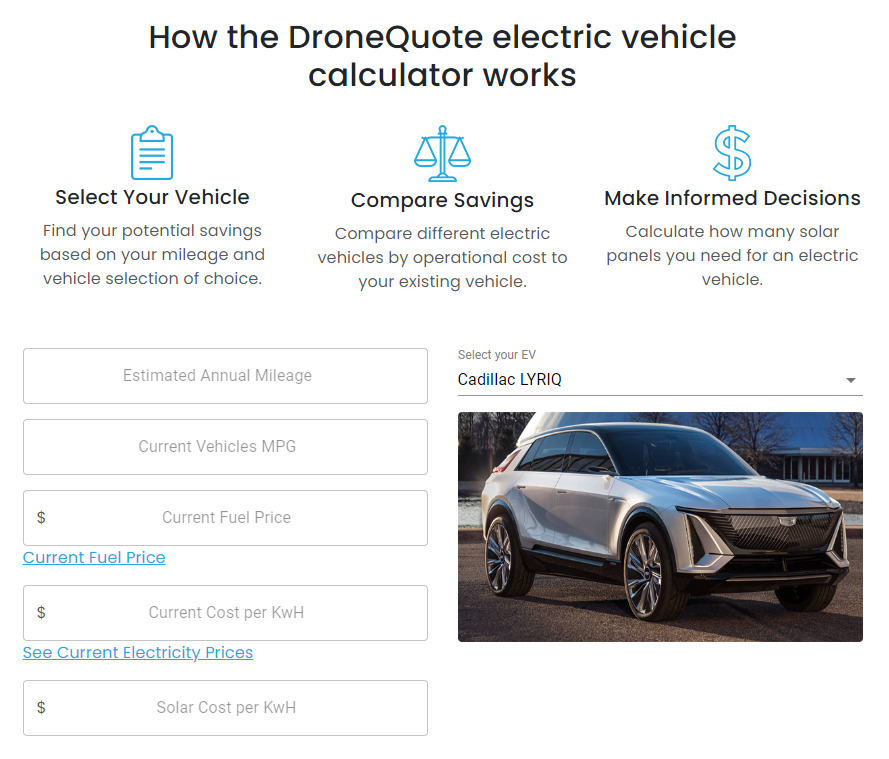

If you are considering installing a solar system, DroneQuote’s electric vehicle calculator can estimate the number of solar panels you need to power your electric vehicle, such as the F-150 Lightning. With the EV calculator, you can compare driving costs and determine the solar capacity required to charge your electric car.

For solar panel quotes related to your EV home charging needs or any solar-related inquiries, contact DroneQuote. Our team is eager to address your questions and assist you in making informed decisions for your solar journey!

FAQs

- What are electric vehicle incentives, and what types of incentives are available?

Electric vehicle incentives refer to various government programs aimed at promoting the use of electric cars. These can take many forms, including federal tax credits, state rebates or grants, and local initiatives such as free charging stations or HOV lane access.

- Do all electric cars qualify for federal tax credits?

No, not all electric vehicles qualify for federal tax credits. To be eligible, a car must meet certain criteria related to battery size, range on a single charge, and other factors. Additionally, there is a cap on the total number of vehicles receiving these incentives yearl.

- What are some other factors that may affect eligibility for EV incentives?

In addition to meeting specific technical requirements for things like battery capacity and range per charge cycle, geographic restrictions or income limits may determine who qualifies for different types of EV incentive programs.

- How do I apply for an EV incentive program?

The application process will depend on the specific program you are applying for – some may require you to submit paperwork directly through your dealership (if purchasing a new car). In contrast, others might involve filling out online applications with relevant government agencies or non-profits that administer these initiatives locally. It’s important to carefully review the requirements and guidelines provided by each program before beginning any application process!