Are you a homeowner in the United States that also uses electricity? If so, you should know that the feds just improved incentives to help you take advantage of renewable energy, make your home more efficient, buy an EV, and another thing or two.

One of the things we do is help educate people about tax incentives and how they make going solar more affordable.

We’re not here to slice and dice the passage of federal policy, BUT we are here to share with you what the Inflation Reduction Act is capable of offering Americans.

The passage of this bill offers benefits to Americans in several ways. We’ll focus on those relative to sustainability and electric vehicles.

What is the solar tax credit 2022?

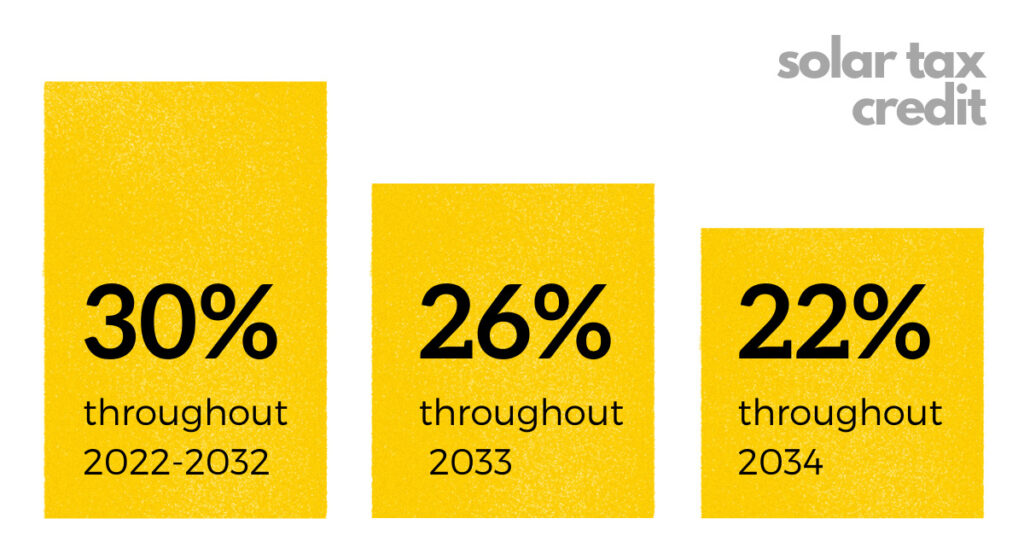

The 30% solar tax credit will last until 2032 then decline to 26% on 2033, and 22% on 2034.

Before this bill passed, the tax credit was 26% of the total purchase price of renewable energy systems from wind or solar energy. This tax credit was scheduled to decline to 22% in the year 2023, after which it was to be eliminated entirely in 2024.

This solar tax credit is extremely important because, in most cases, it would mean the difference between solar making financial sense or not. Though in places where the cost of electricity is high, solar is still very competitive even without the tax credit, but that’s a conversation for another time.

The passage of this bill extended the tax credit for 10 years! Twelve if you count the two additional step-down years from 30%.

This is great news but remember, you still have to be eligible for the tax credit, so don’t let anyone tell you that you’re simply getting a check back from the feds because that’s not right, like 91 degrees.

As a bonus, this change is effective January 1st of 2022, so congratulations on the extra money if you have already installed solar.

Is solar tax credit for you?

In the real world, though, there are a lot of reasons why you shouldn’t go solar, so that tax credit may not matter. You’re still in luck because this bill either extends or creates new tax credits to make your home more energy efficient. If you don’t replace your energy source with solar panels, that doesn’t stop you from saving money on energy costs by improving your home’s energy efficiency.

What if you don’t own your home to take advantage of the solar tax credit or energy efficiency upgrades? Well, as the great Billy Mays would say, but wait, there’s more! This tax bill has something for you if you’re considering an electric vehicle and now also covers used EVs at up to 30% of the purchase price or $4,000.

Another benefit that a whole lot of people can take advantage of is a new tax credit for stand-alone battery systems. Though these systems are not connected to renewable energy for charging purposes, they often are. In other words, portable batteries. These batteries would be eligible for the 30% tax credit starting in 2023 so long as they are at least 3.5kWh or greater in capacity. A really good example of this would be the Ecoflow Delta pro battery.

The fact is that if we do things to use less power, change how we source our power, or change the powertrains of our vehicles, we can potentially save a ton of money, and the inflation reduction act definitely helps keep momentum to make those changes.

If you want to learn more about DroneQuote and how we help people adopt solar and battery systems for their homes, check us out at www.dronequote.net